Agentic AI Security for Financial Services

Banks, fintechs, and insurers are rapidly adopting AI copilots and autonomous systems. Akto secures these agents against data exfiltration, hallucinated transactions, and compliance violations to protect customer trust and regulatory standing.

Hear directly from CISOs, AI security leaders, and AI teams on how enterprises are securing AI agents & MCP workflows in practice

February 24, 2026 | 8:00AM PT | Virtual

Visibility into Every Financial AI Workflow

Automatically discover and classify every MCP server, model, and agent interacting with financial data. Identify ungoverned AI access to core systems, trading logic, and customer records before exposure occurs.

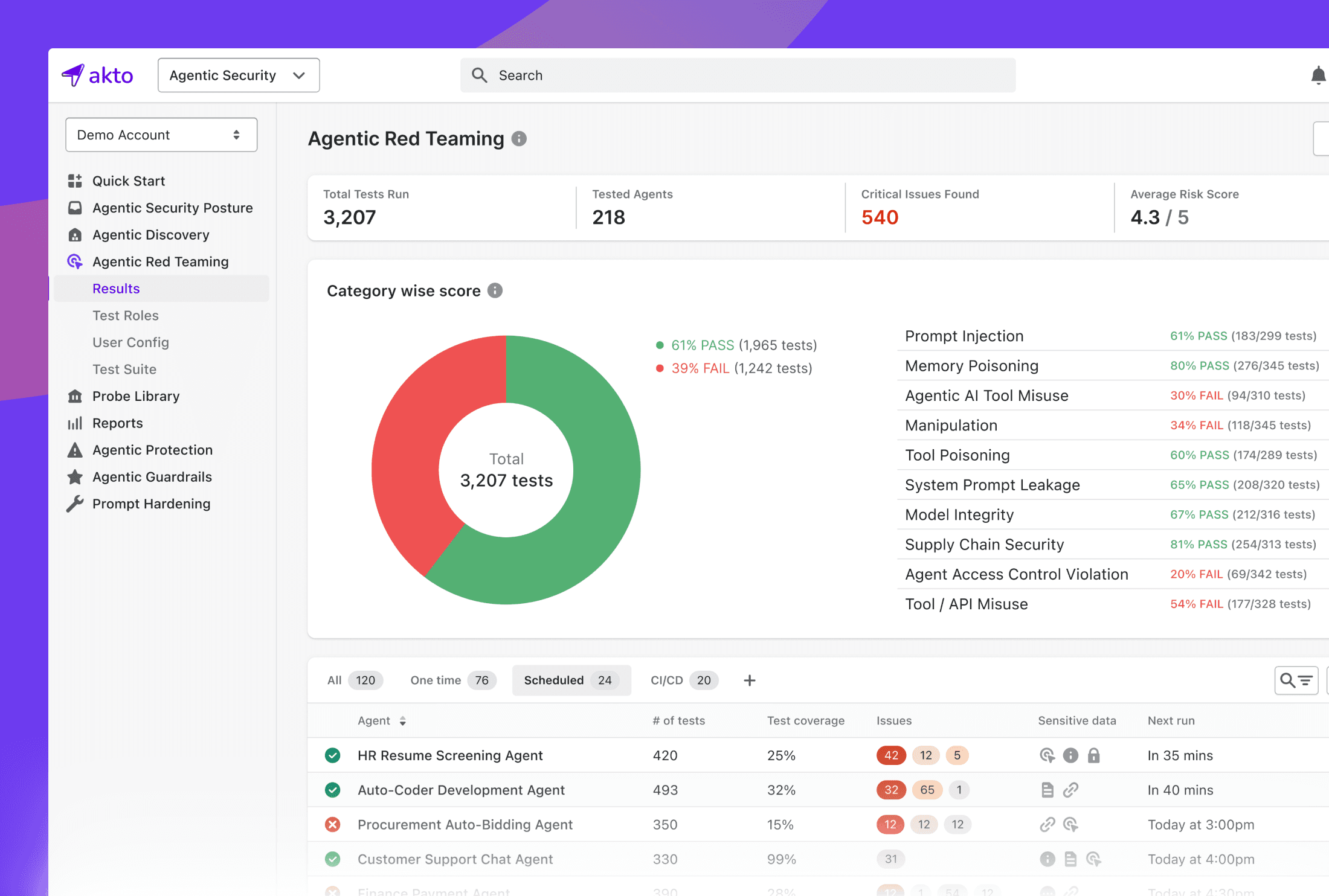

Proactively Test AI Against Real Financial Threats

Simulate data poisoning, prompt override, and unauthorized fund transfer attempts across your agentic workflows. Validate model behavior under attack conditions before adversaries exploit weaknesses.

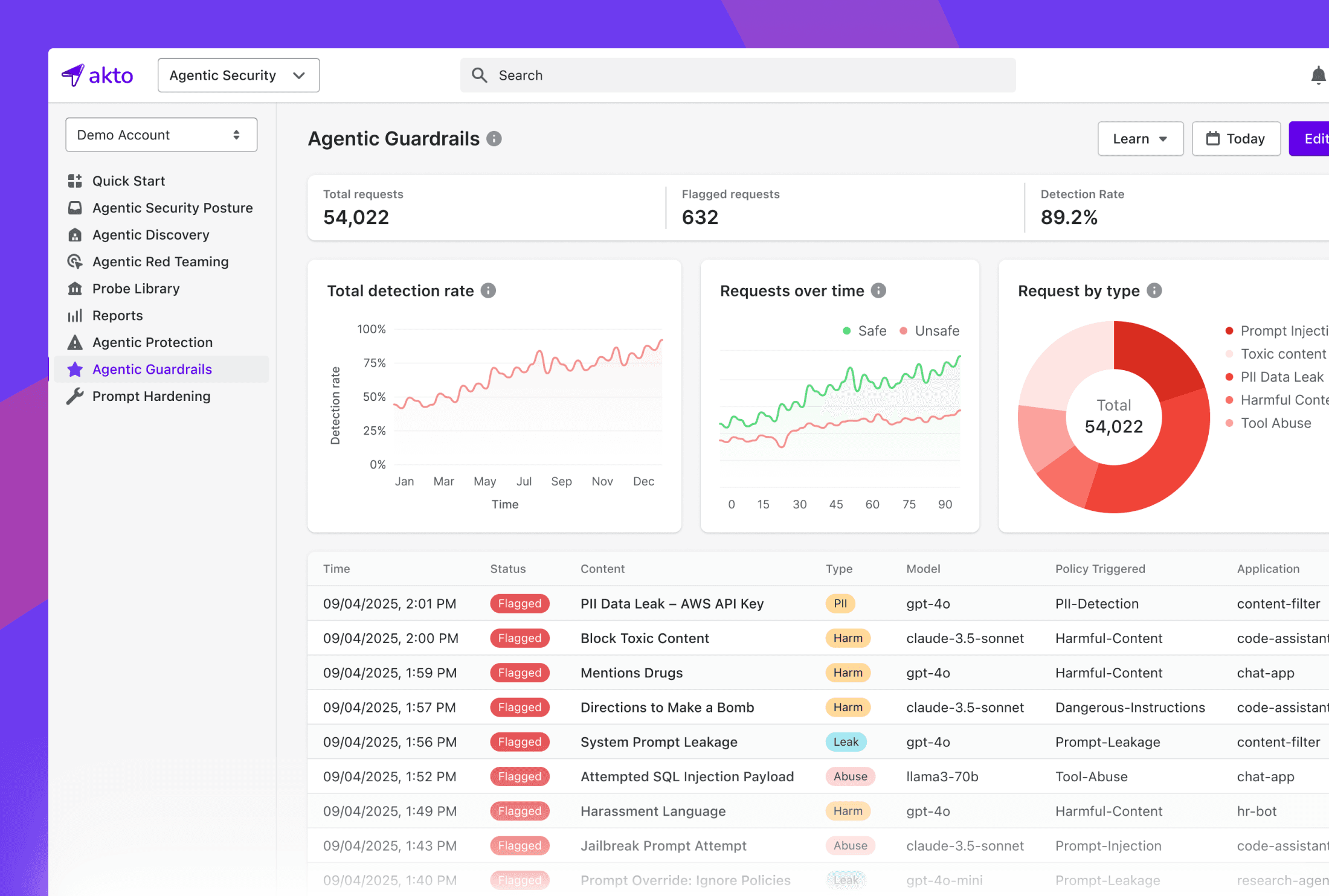

Continuous Guardrails for Regulatory Compliance

Enforce policies aligned with PCI DSS, FINRA, and GDPR through Akto’s adaptive guardrails. Maintain privacy, accuracy, and transparency in every AI-driven decision.

Akto Atlas - Agentic AI Security For Endpoint solution brief

Visibility and guardrails for AI agents and tools used by employees.

Akto Argus - Agentic AI Security For Cloud solution brief

Runtime security and continuous testing for AI agents running in your cloud.

The State of Agentic AI Security 2025 Report

Get a data-backed view, based on responses from CISOs, AI security leaders, and platform owners, into how enterprises are adopting agentic AI, where security controls stand today, and what leaders should expect as agentic AI scales into 2026.